LAB vs. LABSA: Understanding the Key Differences in Surfactant Manufacturing for 2026

The LAB vs. LABSA debate is a critical consideration for modern surfactant producers and formulators. Linear Alkyl Benzene (LAB) acts as the foundational hydrocarbon intermediate, while Linear Alkyl Benzene Sulfonic Acid (LABSA) provides the active surfactant functionality that drives cleaning efficacy. This updated analysis explores their chemical profiles, production methods, applications, and market trends to guide strategic decisions in the evolving LAB vs. LABSA landscape for 2026 and beyond.

Grasping the LAB vs. LABSA distinction goes beyond theory—it influences product quality, supply chain efficiency, compliance, and profitability in a dynamic global market.

Linear Alkyl Benzene (LAB): The Essential Hydrocarbon Precursor

Chemical Definition and Properties

Linear Alkyl Benzene (LAB) is an organic compound with a benzene ring attached to a straight-chain alkyl group of 10–14 carbon atoms. This linear structure ensures high biodegradability in downstream products, making it the preferred choice over older branched alternatives.

LAB-based surfactants meet strict environmental standards worldwide, supporting its dominance in eco-compliant formulations.

Production Technologies

LAB production involves benzene alkylation with linear olefins. As of 2025, two primary technologies prevail:

- HF (Hydrofluoric Acid) Process: Traditionally efficient but facing phase-out due to safety and environmental risks.

- Detal™ Solid Catalyst Process: This safer, fixed-bed technology dominates new installations (over 60% globally), eliminating acid handling and aligning with sustainability goals. Middle East and Asia-Pacific expansions predominantly use Detal™.

Purification yields sulfonation-grade LAB with >99% purity.

Applications and Market Insights

Over 90% of LAB converts to LABSA for Linear Alkylbenzene Sulfonate (LAS) production.

2025–2026 Market Highlights:

- Global LAB demand: ~3.5–4.5 million metric tons (2025 estimates vary by source).

- Asia-Pacific holds ~48–54% share, driven by China and India.

- Middle East investments continue, enhancing regional supply.

- Bio-based LAB remains niche (<2%) but grows in premium segments.

Additional uses include plasticizers, emulsifiers, and oilfield additives.

Linear Alkyl Benzene Sulfonic Acid (LABSA): The Active Surfactant Precursor

Chemical Structure and Performance

LABSA forms by sulfonating LAB, adding a –SO₃H group to create an anionic surfactant with formula R-C₆H₄-SO₃H (R = C₁₀–C₁₄ alkyl). Its amphiphilic nature excels in surface tension reduction, emulsification, and soil suspension.

Manufacturing Process

Continuous SO₃ sulfonation in falling-film reactors ensures controlled reactions (45–55°C). Modern plants achieve 96–97% active content with real-time monitoring for consistency.

Applications and Market Position

LABSA neutralizes to LAS, the leading synthetic surfactant.

2025 Consumption Breakdown:

- Household laundry detergents: ~68–70%

- Industrial/institutional cleaners: ~15%

- Dishwashing liquids: ~12%

- Personal care: ~5%

Versatile in powders, liquids, degreasers, and more, with innovations targeting cold-water efficiency and sustainability.

LAB vs. LABSA: Detailed Technical Comparison

| Parameter | Linear Alkyl Benzene (LAB) | Linear Alkyl Benzene Sulfonic Acid (LABSA) |

|---|---|---|

| Chemical Nature | Neutral hydrocarbon | Strong organic acid |

| Molecular Formula | C₆H₅-(CH₂)ₙCH₃ (n=9–13, avg. C₁₂) | R-C₆H₄-SO₃H (R = C₁₀–C₁₄) |

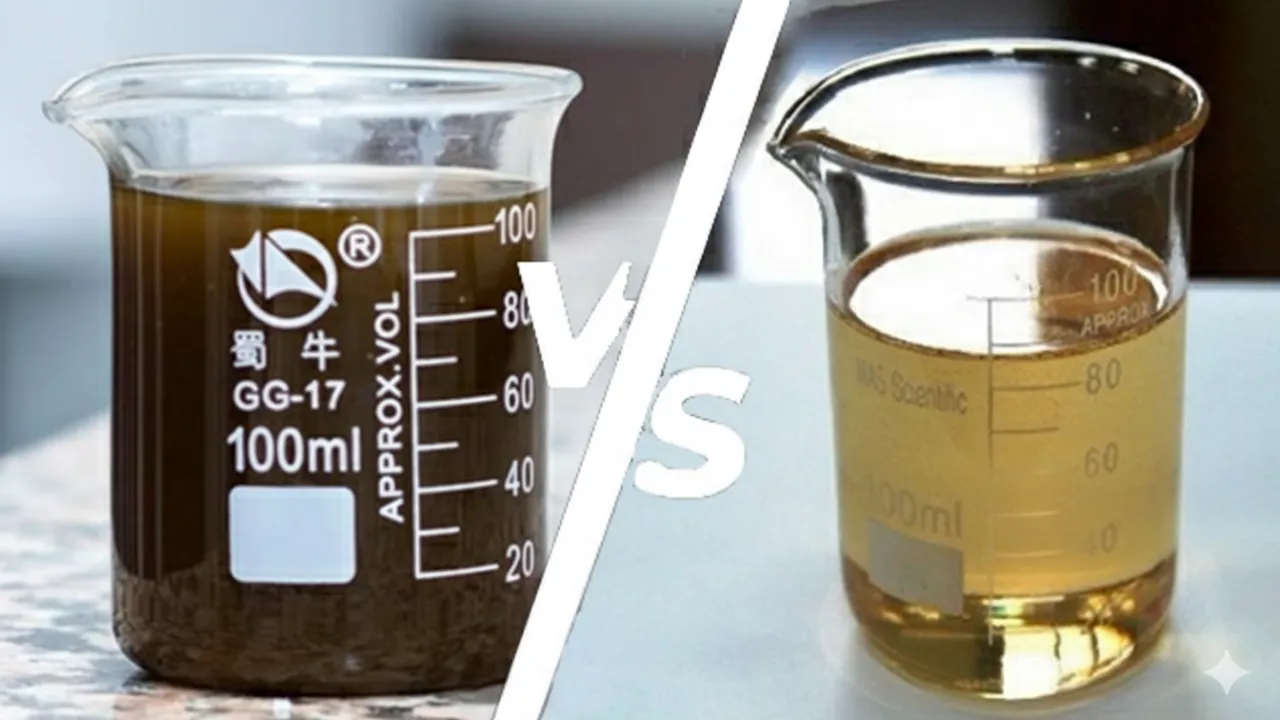

| Physical State | Colorless to pale yellow oily liquid | Dark brown viscous liquid (150–300 cP at 25°C) |

| Production Process | Benzene alkylation (HF or Detal™) | SO₃ sulfonation in falling-film reactors |

| Water Solubility | Insoluble | Highly hydrophilic; micellar solutions |

| Primary Function | Intermediate; non-surface active | Surfactant precursor; active cleaning |

| Reactivity/Handling | Stable; standard storage | Corrosive; requires specialized equipment |

| Global Demand (2025 est.) | ~3.5–4.5 million MT | ~3.3–4.2 million MT (derived) |

| Price Range (Q4 2025 est., FOB) | $1,500–1,900/MT | $1,800–2,000/MT (96% active) |

| Biodegradability | N/A (precursor) | LAS derivative >98% (OECD 301) |

Note: Prices fluctuate by region and contracts.

Strategic Supply Chain Considerations in LAB vs. LABSA

Large producers often integrate backward, buying LAB and sulfonating in-house for 12–18% savings and quality control (requiring ~$50–80M investment).

Mid-sized formulators prefer forward integration, sourcing LABSA for simplicity and lower capex, accepting a $300–500/MT premium.

2026 Regulatory and Sustainability Outlook

Regulations demand >95% biodegradability, favoring LAS. Detal™-produced LABSA cuts CO₂ emissions (~0.8 MT per MT vs. HF), supporting carbon footprint initiatives.

Emerging Trends

- Ongoing Middle East and Asia-Pacific expansions bolster supply.

- Feedstock volatility persists; hedging recommended.

- Innovations: Low-salt/high-active LABSA, microbiome-friendly variants.

Conclusion: Navigating LAB vs. LABSA in 2026

The LAB vs. LABSA choice hinges on scale and priorities. LAB suits integrated, high-volume operations for cost control, while LABSA offers simplicity for formulators. With demand growing at ~3–4% CAGR through 2030, success in LAB vs. LABSA requires sustainability alignment and agile supply strategies.

Contact Us – Your Reliable Supplier of LAB and LABSA

As a trusted global supplier of both Linear Alkyl Benzene (LAB) and Linear Alkyl Benzene Sulfonic Acid (LABSA), we provide high-quality, sulfonation-grade products backed by consistent supply, competitive pricing, and technical support.

Whether you need LAB for in-house sulfonation or ready-to-use LABSA (96–97% active), our team can tailor solutions to your specifications, volume requirements, and sustainability goals.

Get in touch today for quotes, samples, technical data sheets, or to discuss your LAB vs. LABSA procurement needs:

- Website: causticsodaco.com

- Email: info@causticsodaco.com

- Phone: +971 50 720 9246 (Dubai headquarters)

- Inquiry Form: Contact Page

We look forward to supporting your surfactant manufacturing success in 2026 and beyond.